Panel discussion on...

Cognitive health

Welcome in the world of alternative meat: analytical challenges and perspectives

What are the latest global and regional trends in cognitive health supplements, and how do companies tailor their products to meet the unique needs of different markets?

The demand for ingredients and products that enhance cognitive performance, mental energy, and focus is rapidly growing across all age groups. While concerns about cognitive decline persist, today’s fast-paced world has shifted the focus toward improving memory, retention, and attention to meet modern mental demands (1).

Market Growth Trends:

- Global Market: The brain health supplements market was valued at $8.63 billion in 2022, according to Grand View Research, with a projected 13.3% CAGR through 2030 (1).

- Regional Growth: In the U.S., the brain health supplements market is expected to grow at a CAGR of 11.2% CAGR, maintaining dominance with 40.1% of the global market share in 2022 (1). This growth is fueled by rising awareness around cognitive and mental health issues, such as attention deficits, declining memory, anxiety, and depression, particularly in younger demographics (1).However, the Asia Pacific region is expected to have the highest growth, with a CAGR of 15.8% from 2023 to 2030. This surge is attributed to a growing preference for natural supplements over traditional pharmaceuticals, reflecting a broader shift toward holistic health solutions.

- Consumer Interest: The brain health category ranked as the third-fastest growing condition-specific supplement market in 2023, with top projections for 2024, and predictions to remain in the top three through 2027, as per the 2024 NBJ Condition-Specific Report (2).

Younger, health-conscious generations, particularly Gen Z and Millennials, are driving the growth of cognitive health supplements. These groups face high-stress lifestyles and are increasingly motivated to seek out products that support mental performance.

According to the 2024 CRN Consumer Survey (conducted by Ipsos):

- 75% of Americans regularly use supplements (3).

- 91% of users say supplements are essential to maintaining their health and well-being (3).

Generational Influence on Demand:

Younger, health-conscious generations, particularly Gen Z and Millennials, are driving the growth of cognitive health supplements. These groups face high-stress lifestyles and are increasingly motivated to seek out products that support mental performance.

According to the 2024 CRN Consumer Survey (conducted by Ipsos):

- 75% of Americans regularly use supplements (3).

- 91% of users say supplements are essential to maintaining their health and well-being (3).

Trending Ingredients:

Globally, the cognitive health space is returning to foundational ingredients that have clinical efficacy:

- Omega-3s: Essential for brain function

- Magnesium: Supports focus and neurological health

- Probiotics: Emerging gut-brain connection

- Choline (Citicoline/Cognizin®) – Memory and attention

- Adaptogens (Ashwagandha, Rhodiola, CurQfen®) – Stress resilience and cognition

- Mushrooms (Lion’s Mane) – Memory and neurogenesis

Tailoring Products to Meet Unique, and Individual Needs:

Personalized health is driving consumer demand globally, with individuals seeking customized products that fit their unique lifestyles. According to Innova Market Insights , people are taking a proactive approach to their health through diet and physical activity—and they want it customized (4). Consumers are saying loud and clear: “Make it for me!”

Two key consumer groups are shaping the market:

- Aging Consumers: Focused on maintaining cognition and memory, they prefer fish/animal oils (rich in omega-3s) and multivitamin formulations (2).

- Younger Generations (Gen Z & Millennials): Driven by the need to amplify focus, mental energy, and stamina, they favor ingredients like minerals, choline/citicoline, amino acids, herbs (e.g., ashwagandha, rhodiola, turmeric [curcumin]), and functional mushrooms (e.g., lion’s mane) (2, 5).

By aligning with these needs, companies can create impactful, personalized solutions that resonate across demographics, both regionally and globally.

What are the most promising breakthroughs in cognitive health and/or supplements over the past year, and how are they influencing product development?

In the quest for optimal health and wellness, one persistent challenge in nutraceuticals is ensuring the effective delivery of bioactive nutrients. Despite advancements in supplement technologies, issues like low solubility, limited bioavailability, and rapid metabolism continue to limit the potential of many health-promoting compounds. However, recent breakthroughs in delivery system technologies are reshaping product development and driving the industry forward.

While delivery system technologies date back to the 1950s, their potential is now gaining traction in the nutraceutical industry, backed by robust scientific validation (6). These systems address critical challenges, including particle size, permeability, solubility, stability, and site-specific targeting, ensuring that active ingredients are absorbed effectively by the body (6).

Challenges in Traditional Delivery Systems:

- Poor solubility and bioavailability

- Instability and short shelf life

- Breakdown of bioactives in the stomach

- Low bioactive loading capacity in liposomes, micelles, and nanoemulsions

Nearly 15 years ago, Akay Bioactives introduced a patented plant-based, clean-label delivery system utilizing self-emulsifying reversible hydrogel science. This technology significantly enhances bioavailability, solubility, and stability, optimizing ingredient transport across cell membranes.

One notable example is its application to curcumin, a key bioactive in turmeric that traditionally faces bioavailability issues with absorption rates below 1%. When formulated with our technology, curcumin’s (CurQfen®) bioavailability improves dramatically, with studies showing a 45.5x increase in 'free' curcuminoid bioavailability and 347x enhanced bioavailability for crossing the blood-brain barrier (7, 8). These advancements allow for sustained release, optimized dispersion, and reduced dosage requirements, significantly improving its therapeutic potential, particularly for cognitive health.

How has the consumer understanding of brain health evolved recently, and what role do branded ingredients play in shaping their trust and preferences?

Today’s consumers recognize that their brains need as much nourishment as their bodies to meet the relentless demands of modern life. With increasingly fast-paced lifestyles and often less nutritious diets, people are turning to functional foods, beverages, and dietary supplements to support cognition, memory, focus, and mental sharpness.

Recent studies underscore this shift:

- 25% of U.S. adults and 36% of those 74+ take supplements for brain health. Among them, 71% aim to improve memory, and 60% seek mental sharpness (9, 10).

- The 2023 U.S. Food & Health Survey found that 25% of users prioritize brain function, alongside energy, sleep, and emotional well-being (10, 11).

Unlike past reliance on word-of-mouth remedies, today’s consumers have instant access to AI-driven insights, social media, and product reviews. With this information overload, they increasingly seek science-backed, transparent solutions.

Branded ingredients backed by clinical research build trust and preference by demonstrating efficacy and safety. For example, CurQfen®, a bioavailable curcumin ingredient, boasts over 25 peer-reviewed studies, reinforcing its credibility. Consumers can search branded logos online, access published research and make informed decisions.

In an era of heightened awareness, clinically substantiated, branded ingredients provide the assurance and credibility consumers demand in brain health solutions.

Are there specific cognitive functions, such as memory, focus, or stress management, that are driving the majority of consumer interest? Why?

Memory, attention/focus, and mood/stress management are at the forefront of consumer interest in cognitive health, reflecting the evolving needs of diverse demographics and their lifestyles.

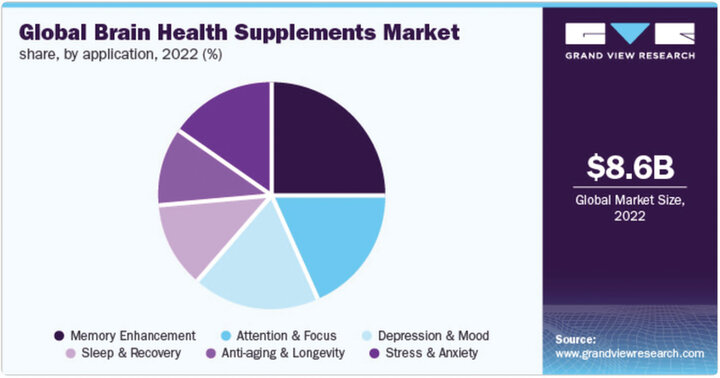

According to Grand View Research, the memory enhancement segment led the market in 2022, accounting for over 25.2% of the share (1) (See chart below).

It was suggested that rising academic competition has driven demand for memory enhancers and brain health supplements among students, while the increasing preference for natural and herbal supplements is expected to fuel further growth in this category (1).

Recent data from Innova Market Insights (Briefing Series | Global Trends: Supplement Market Promises “Self-Care before Healthcare” 2024) confirms this trend, showing that brain/mood health has become one of the top three health claims in the supplement market, alongside immune health and energy & stamina (12). Over the past five years, these claims have solidified their positions as dominant market drivers. Notably, mental acuity claims have gained significant traction, with penetration nearly doubling since 2019-2020 (12).

This surge reflects a broader consumer shift toward holistic health, recognizing that nutrition can positively impact not only physical health but also brain performance and mental/emotional well-being. As a result, the cognitive health category is rapidly segmenting, with products targeting specific aspects of mental health, such as:

- Memory enhancement & brain protection

- Focus & concentration for productivity

- Mood regulation & stress management

- Mental energy & stamina for efficiency

The growing understanding of how diet and supplements influence brain function has driven innovation in this space, offering consumers tailored solutions for their cognitive health needs. As the market continues to expand, products that align with these priorities are set to capture the majority of consumer interest.

What role does sustainability play in the cognitive health space, particularly in sourcing and manufacturing ingredients?

Sustainability is no longer a trend—it’s a permanent priority shaping ingredient sourcing and manufacturing. Today’s consumers demand natural, traceable, eco-friendly products, driving industry-wide change. Since 2007, Akay Bioactives has prioritized soil and water conservation, ethical labor practices, community development, and biodiversity preservation, ensuring we deliver premium herbs and spices while safeguarding ecosystems. Using tools like the Trace Share app, we enhance traceability by recording farming activities in real time. We’ve also pledged to plant 1 million trees, with over 285,800 already planted, supporting climate change mitigation and biodiversity protection—creating lasting value for consumers, communities, and the planet.

Which emerging ingredients show the most potential for supporting cognitive health, and how are they being clinically tested?

CurQfen®, a groundbreaking curcumin complex from Curcuma longa, is redefining cognitive health with 45.5x higher bioavailability of 'free' curcuminoids and superior blood-brain barrier permeability. It’s substantiated ability to enhance brain-derived neurotrophic factor (BDNF) and reduce neuroinflammation positions it as a leader in healthy brain aging. (7, 8, 13, 14).

Recent clinical trials, including a Frontiers in Dementia study, showed significant improvements in cognitive decline symptoms compared to unformulated curcumin and placebo at 400 mg twice daily over six months (14). Key cognitive markers improved, including amyloid-β, tau proteins, BDNF, and neuroinflammation.

With instant water dispersibility, stability, and palatable taste, CurQfen meets both consumer and formulator demands. Backed by 25+ peer-reviewed studies, it’s a trusted solution for cognitive health, brain aging, and overall well-being, blending nature with science to support evolving consumer needs.

Where do you see the cognitive health supplement market in the next 5 to 10 years, and what trends or innovations do you anticipate will define its future?

Over the next 5 to 10 years, the cognitive health supplement market is poised for significant growth and transformation, driven by advancements in science, changing consumer demands and attitudes, and an increased focus on holistic well-being. Here are five potential trends and innovations that may help to shape its future:

1. Personalization and Precision Nutrition

The rise of AI-driven health tech, wearable devices, and genetic testing will enable consumers to tailor cognitive supplements to their unique needs. Products will focus on personalized solutions for memory, focus, stress management, and overall brain health based on individual biomarkers and lifestyles.

1. Brain-Gut Axis Focus

Emerging research on the connection between gut health and cognitive function will drive the development of supplements that combine prebiotics, probiotics, and postbiotics with cognitive health ingredients like adaptogens. These products will target the brain-gut axis to improve focus, mood, and mental clarity.

2. Holistic Mental Wellness

As mental health awareness increases and stigmas diminish, the market is set to grow and will expand with products that will support emotional resilience and manage stress. Supplements will integrate cognitive benefits with overall mental wellness to cater to the increasing demand for mind-body balance.

3. Cognitive Support Across Life Stages

The market will segment further to offer life stage-specific formulations:

- Products for younger audiences, focusing on academic performance, attention, and focus to bypass the need for pharmaceuticals.

- Working professionals seeking productivity and stress management with the ever-increasing demands of modern life.

- Aging populations, emphasizing memory preservation and neuroprotection to support health as life expectancy increases.

4. Growth of Functional Beverages and Foods

Traditional capsules and tablets are becoming less appealing globally as consumers seek more convenient options. With the growing demand for personalized supplementation across all life stages, cognitive health products are increasingly being incorporated into functional beverages, snacks, and ready-to-eat formats, offering practical and enjoyable alternatives.

The future of cognitive health supplements lies in personalization, innovation, and integration. Companies that stay ahead by leveraging emerging technologies, embracing sustainability, and delivering clinically substantiated, multi-functional products will lead the charge in shaping this dynamic and rapidly evolving market.

Figure 1. Overlaid Representative Chromatograms for PBM (black) and Organic Beef (pink) (6).

Panelists

References and notes

- Grand View Research. Brain health supplements market size, share & trends analysis report by product (natural molecules, herbal extracts, vitamins & minerals), by application (memory enhancement, mood & depression, attention & focus), by region, and segment forecasts, 2023-2030 [Internet]. San Francisco (CA): Grand View Research; c2023 [cited 2025 Jan 10]. Available from: https://www.grandviewresearch.com/industry-analysis/brain-health-supplements-market

- Nutrition Business Journal. NBJ Condition Specific Report. Boulder (CO): Informa; ©2024 [cited 2025 Jan 10]. Available from: https://www.nutritionbusinessjournal.com

- Council for Responsible Nutrition. CRN survey shows consistent supplement usage, increase in specialty product use over time [Internet]. Washington (DC): Council for Responsible Nutrition; 2024 [cited 2025 Jan 10]. Available from: https://crnusa.org/newsroom/crn-survey-shows-consistent-supplement-usage-increase-specialty-product-use-over-time

- Innova Market Insights. Trends Insider: Now & Next in Personalized Nutrition Global Report—November 2024 [Internet]. Arnhem (Netherlands): Innova Market Insights; 2024 [cited 2025 Jan 10].

- Supplements buzz: How Gen Z and Millennials are shaping consumer healthcare [Internet]. Munich (Germany): ISPO [cited 2025 Jan 10]. Available from: https://www.ispo.com/en/health/supplements-buzz-how-gen-z-and-millennials-are-shaping-consumer-healthcare

- Ezike TC, Okpala US, Onoja UL, Nwike CP, Ezeako EC, Okpara OJ, Okoroafor CC, Eze SC, Kalu OL, Odoh EC, Nwadike UG, Ogbodo JO, Umeh BU, Ossai EC, Nwanguma BC. Advances in drug delivery systems, challenges and future directions. Heliyon. 2023 Jun 24;9(6):e17488. doi: 10.1016/j.heliyon.2023.e17488. PMID: 37416680; PMCID: PMC10320272.

- Kumar D, Jacob D, Subash PS, Maliakkal A, Johannah NM, Kuttan R, Maliakel B, Konda V, Krishnakumar IM. Enhanced bioavailability and relative distribution of free (unconjugated) curcuminoids following the oral administration of a food-grade formulation with fenugreek dietary fibre: A randomised double-blind crossover study. J Funct Foods. 2016;22:578-587. doi:10.1016/j.jff.2016.01.039. Available from: https://www.sciencedirect.com/science/article/pii/S1756464616000426

- Krishnakumar IM, Maliakel A, Gopakumar G, Kumar D, Maliakel B, Kuttan R. Improved blood–brain-barrier permeability and tissue distribution following the oral administration of a food-grade formulation of curcumin with fenugreek fibre. J Funct Foods. 2015;14:215-225. doi:10.1016/j.jff.2015.01.049. Available from: https://www.sciencedirect.com/science/article/pii/S1756464615000535

- AARP. Brain Health and Dietary Supplements Survey. 2019. Available from: https://www.aarp.org/content/dam/aarp/research/surveys_statistics/health/2019/brain-health-and-dietary-supplements-report.doi.10.26419-2Fres.00318.001.pdf [Accessed 2025 Jan 12].

- Young HA, Cousins AL, Byrd-Bredbenner C, Benton D, Gershon RC, Ghirardelli A, Latulippe ME, Scholey A, Wagstaff L. Alignment of consumers’ expected brain benefits from food and supplements with measurable cognitive performance tests. Nutrients. 2024;16(12):1950. doi:10.3390/nu16121950

- International Food Information Council (IFIC). 2023 Food and Health Survey. 2023. Available from: https://foodinsight.org/wp-content/uploads/2023/05/IFIC-2023-Food-Health-Report.pdf.

- Innova Market Insights. Global Trends: Supplement Market Promises “Self-Care Before Healthcare” 2024. Briefing Series. 2024.

- Kannan RG, Abhilash MB, Dinesh K, Syam DS, Balu M, Sibi I, Krishnakumar IM. Brain regional pharmacokinetics following the oral administration of curcumagalactomannosides and its relation to cognitive function. Nutr Neurosci. 2022 Sep;25(9):1928-1939. doi: 10.1080/1028415X.2021.1913951. Epub 2021 Apr 20. PMID: 33877014.

- Das SS, Gopal PM, Thomas JV, Mohan MC, Thomas SC, Maliakel BP, Krishnakumar IM, Pulikkaparambil Sasidharan BC. Influence of CurQfen®-curcumin on cognitive impairment: a randomized, double-blinded, placebo-controlled, 3-arm, 3-sequence comparative study. Front Dement. 2023 Sep 13;2:1222708. doi: 10.3389/frdem.2023.1222708. PMID: 39081970; PMCID: PMC11285547.