KEYWORDS

Personalised nutrition

Innovation

Health

Technology

Industry trends

The personalized nutrition market, as other industries, has not been spared from global challenges starting from Ukraine's turbulent war, to extreme weather and rising cost of living. However, this has not stopped consumers' interest in health personalization. In fact, a recent survey showed that 39% of US consumers prioritize the importance of spending on their wellbeing even more now, than they did a year before (1). Despite Personalised nutrition becoming a crowded market, there are still plenty of untapped opportunities for food and ingredient brands looking to capture consumers´ attention as and when the dust has settled. This article will focus on the current state of the Personalised nutrition industry and how food, ingredient and health brands need to act smart and capitalize on this trend.

Abstract

An Industry in a state of flux

The Personalised nutrition industry was estimated at $9 billion dollar in 2021 with a CAGR of 10% (2). Major drivers for growth in the industry have included growing consumer interest in health and wellness, rapid advances in technology, advances in cloud computing power as well as unsustainable health expenditure which sparked a food as medicine movement. Recent consumer surveys indicate that it is Millennials and Gen-Z´s that are most interested in Personalised nutrition with over 30% indicating that they are prioritizing their health more than a year ago (1).

There is certainly no shortage of Personalised nutrition offerings on the market, spanning from smarteating platforms to solutions that provide feedback on biomarkers. While the total of new launches is down year on year (15), there are still interesting trends observed within the different segments.

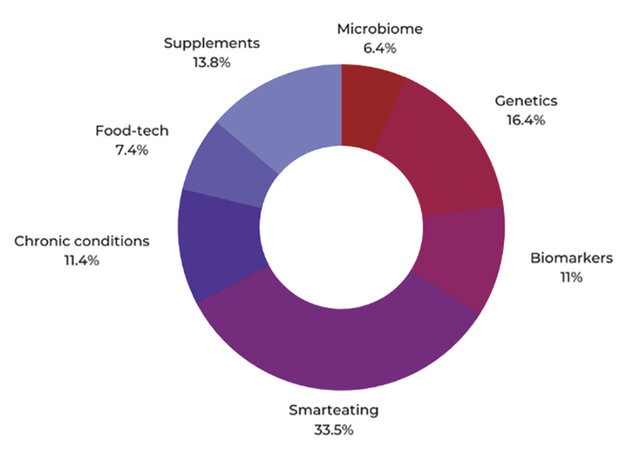

A breakdown of the over 600 solutions found inside the Qina platform- the hub for data and insights in Personalised nutrition, are illustrated in Figure 1.

Figure 1. Source: Qina platform.

It is clear from our data that the Smarteating solutions that provide dietary advice and recommendations based on dietary preferences and health goals using survey data are still taking up the largest share of the industry.

A slowdown in new investments

The shifts in the industry are a direct result of consumer demand, scientific advances and the challenging economic climate. With a looming global recession, it comes as no surprise that overall investment in digital healthcare is down by nearly 50%, just in Europe alone there's been a 16.1% decline in deal value in comparison to 2021 (3).

This shift has been felt strongly in the Personalised nutrition industry where we saw a drop in new investment rounds and new launches are down from 60 in 2016 to 23 in 2021 (15). It is also important to highlight that despite women making up most of the health and food decisions, the proportion of capital by women-only teams has actually dropped to 1% from 3% (3).

Despite a crowded market, there is still a lot of work to do

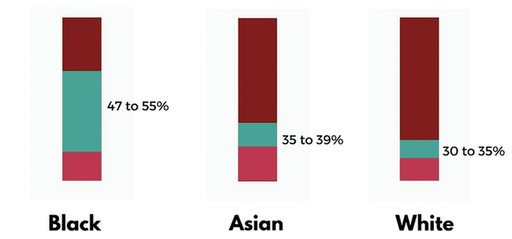

With a growing interest in holistic health, more consumers are looking to get superior health benefits from their food and beverages with ingredients that are nutritious and from sustainable sources (FMCG gurus). This gives ingredient and food brands an opportunity to serve this customer group better. But is what we have currently not enough? Apparently not. A recent survey by McKinsey demonstrated that 47 to 55% of black consumers, 35-39% of Asians and only 30- 35% of white consumers wanted more solutions to meet their health & wellness goals. This means that not only is there a gap in terms of available solutions, there is clearly a lack diversity (Figure 2).

Figure 2. Source: Adapted from McKinsey 2022.

Where are the pockets of growth?

Based on our market intelligence, some segments are growing faster than others as outlined below:

Personalized nutrition supplements – Grew by 35.8% in 2021 alone according to the Nutrition Business Journal (4). We expect this number to be down in 2022, as consumers ditch luxuries while they are feeling the pinch of rising costs. However, we expect to see this to pick up again with a shift from simple pill packs to more personalized options such as 3D printed gummies as made by Nourished.

Sports nutrition – The active & sports nutrition market is estimated to growth by 8% (5) While starting from a small base, we have seen a rise in consumer interest and new launches of active and sports nutrition solutions that combine tracking with personalized feedback. Personalized nutrition products are focused around personalized protein for recovery and strength and improving gut health, energy and focus.

Metabolic health – The metabolic testing market is estimated to be valued at $1.1bn by 2030 (6). In Personalized nutrition, this has translated into a plethora of continuous glucose monitors paired with personalised nutrition advice.

Behaviour change – Solutions that help consumers change their behaviour are on the rise, with more companies pairing AI driven digital behaviour change techniques with human-based coaching.

Wearables – Are moving slowly into the areas of wellness by going beyond just tracking to personalization where wearables are paired with biomarker insights and personalised actionable feedback. For example, Insidetracker recently paired with Apple to provide actionable dietary and lifestyle advice based on user data.

State of the science

Historically, Personalized nutrition has been perceived as a very young and emerging industry with very few scientific publications to back up the purported health benefits. This is perception is changing slowly as big strides have been made by stakeholders across industry and academia to investigate the potential and benefits of a personalized approach. To date, the number of publications listed on the Qina platform connected with Personalised solutions in the industry, exceeds 228. Albeit still small, there is a growing body of evidence supporting a personalised approach and a shift away from the wellness industry, with personalized nutrition deeply rooted in the science. Landmark studies such as Predict (7) and Zeevi et al (8) have paved the way for more research in terms of providing personalisation using a digital approach. Earlier this year, another landmark study published by researchers at Maastricht university (9) demonstrated that modulating macronutrient composition based on Insulin resistant phenotypes, results in superior metabolic health outcomes.

Other interesting studies include the validation of image-based nutrition analysis tools such as DietID (10) and Keenoa (11) as well as a study conducted by researchers in the United Kingdom that demonstrated superior weight loss outcomes via digital and online Diabetes prevention programme delivery using Oviva (12).

The opportunity for Ingredient and Food brands

With a global Food as medicine movement, a shift towards plant-based eating and growing concerns over rising inequality, consumers are acutely aware of how their choices and actions can make an impact on their own health, the wider society and the environment.

There are a number of ways that companies and brands can engage and get involved in Personalised nutrition.

- Develop products that meet the needs of consumers with specific health benefits. This means not only demonstrating effectiveness in clinical trials, but translating the benefits into measurable every day solutions that consumers can feel. This could include citizen science projects or decentralized trials

- Consumers are planning to spend more on services in comparison to products in the coming year (1) this means that companies need to ensure they can be found online, provide quality content and expert support

- Leverage new technologies such as natural language processing to unravel hidden patterns, trends and sentiment in terms of consumer behaviour.

- Proactively engage with consumers who are hard to reach and ready to spend on their health. This means finding new communities, online groups and experts to get more diverse perspectives and opinions.

- Partner with brands to help tech-savvy consumers understand how specific foods, ingredients affect their physiology.

- Consider developing products for specific consumer segments using a more agile and targeted approach such as localized production.

Seek out experts who understand the industry well, have reliable market data, possess a blend of domain, industry and technology expertise to find and connect with the right partners and shorten your time to launch.

Change on the horizon

As the Personalised nutrition industry takes shape, new challenges and changes are on the doorstep for which stakeholders will need to be prepared.

#1 Increased regulation related to the integration of Artificial Intelligence (AI)

AI has been increasingly integrated into many solutions, products and apps with equally increasingly growing ethical concerns from many angles. From lawsuits around Facial recognition, to risking increasing inequality owing to bias is not new, but to date there have only been guidelines, without any legal ramifications for companies who innovate with these new technologies. While many frameworks and white papers exists, the EU and China are really leading on AI initiatives. In 2019, the EU released the EU Framework for ethical AI (13) and this year towards the summer, things will be hotting up with the release of the AI act (14).

The new legislation focuses on 4 key areas:

- Unacceptable risks, such as the use of AI in social scoring by governments

- High-risk uses, such as in educational or vocational training, employment, management of workers and remote biometric identification systems, high risk areas are like AI scanning tools that rank job applicants.

- Limited-risk applications with specific transparency obligations (e.g., a requirement to inform users when interacting with AI such as chatbots).

- Minimal-risk AI, such as spam filters.

This means that companies using AI, will need to audit how they are using data to feed their algorithms.

#2 Rapid advances in Natural language processing

The use of technologies such as Natural language processing provides the opportunity to analyse, summarize and operationalize natural spoken language. Some great use cases include sentiment analysis, named entity recognition as well as text summarization. This means large volumes of text can be summarized and even simplified to be suitable to be understood by a 6-year old.

Such rapid advances in technology will likely mean that consumers will expect such interaction with brands soon.

#3 Privacy becomes serious business

This year will mark a profound shift in the philosophy underlying data privacy laws in the United States, from a "harms-prevention-based" to one based on individual rights, exemplified by Europe's General Data Protection Regulation (GDPR). This is a huge step forward and will only mean that consumers will (hopefully) be more protected as usage of digital tools will only increase.

Summary

The Personalised nutrition industry has not been spared from the damaging effects of so many global events. Despite this, there is growing optimism that as with the COVID pandemic, consumer interest in health and nutrition will only be heightened. The Personalised nutrition industry is fast-moving and crowded, yet there are positive signs that the industry is starting to separate itself from the general wellness industry through solid research and demonstration of superior health benefits, as well as tightening regulation.

This means that companies and brands need to jump at the opportunity to understand how best to service specific consumer segments with a range of health goals and dietary preferences in a collaborative and data-driven way. The future of Personalised nutrition will be about providing better, evidence-based solutions and inclusive solutions with measurable benefits. Companies that are not harnessing the consumer appetite for health as well as rapidly advancing technologies today, will be without a doubt, the Kodak moment of tomorrow.

References and notes

- Still feeling good: The US wellness market continues to book, McKinsey (2022) available at https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/still-feeling-good-the-us-wellness-market-continues-to-boom

- Personalized Nutrition Market to Perceive Promising Growth of USD 20.14 Billion with CAGR of 10.50% By 2029: Size, Share, Industry Analysis, Trends And Value Forecast, Data bridge market research (2022) available at https://www.globenewswire.com/news-release/2022/09/16/2517398/0/en/Personalized-Nutrition-Market-to-Perceive-Promising-Growth-of-USD-20-14-Billion-with-CAGR-of-10-50-By-2029-Size-Share-Industry-Analysis-Trends-And-Value-Forecast.html

- Hot or not: Where European VC funding went in 2022 available online at https://pitchbook.com/news/articles/2022-europe-israel-vc-funding-breakdown

- Nutrition Business Journal Personalized nutrition special report (2022) available at https://store.newhope.com/collections/reports/products/personalized-nutrition-special-report-2022

- Europe Sport nutrition market 2023-2028 available online at https://www.mordorintelligence.com/industry-reports/europe-sports-nutrition-market

- Global metabolic testing market by 2030 - https://www.globenewswire.com/en/news-release/2022/10/28/2543696/0/en/Metabolic-Testing-Market-Worth-US-1125-26-million-by-2030-Growth-Plus-Reports.html

- Berry, S.E et al .,Human postprandial responses to food and potential for precision nutrition. Nat Med26, 964–973 (2020). https://doi.org/10.1038/s41591-020-0934-0

- Zeevi et al. Personalized nutrition by prediction of glycemic responses. Cell Vol:163, issue nr.5: 1079-1094, Nov 19 (2015) doi https://doi.org/10.1016/j.cell.2015.11.001

- Inez Trouwborst, et al.Cardiometabolic health improvements upon dietary intervention are driven by tissue-specific insulin resistance phenotype: A precision nutrition trial, Cell Metabolism, Volume 35, Issue 1, 2023, Pages 71-83.e5, ISSN 1550-4131, https://doi.org/10.1016/j.cmet.2022.12.002

- Radtke, M.D.et al. Validation of Diet ID™ in Predicting Nutrient Intake Compared to Dietary Recalls, Skin Carotenoid Scores, and Plasma Carotenoids in University Students. Nutrients2023, 15, 409. https://doi.org/10.3390/nu15020409

- Moyen A et al. Relative Validation of an Artificial Intelligence–Enhanced, Image-Assisted Mobile App for Dietary Assessment in Adults: Randomized Crossover Study J Med Internet Res 2022;24(11):e40449 doi: 10.2196/40449

- Barron, E, Bradley, D, Safazadeh, S, et al. Effectiveness of digital and remote provision of the Healthier You: NHS Diabetes Prevention Programme during the COVID-19 pandemic. Diabet Med. 2023; 00:e15028. doi:10.1111/dme.15028

- Ethical guidelines for trustworthy AI (2019) available at https://digital-strategy.ec.europa.eu/en/library/ethics-guidelines-trustworthy-ai

- European commission. Regulation of the European Parliament and of the council laying down harmonised rules on artificial intelligence (artificial intelligence act) and amending certain union legislative acts (2021) https://artificialintelligenceact.eu/the-act/

- Qina LDA. The Hub for data and insights in Personalised nutrition. Available online at https://qina.tech