Panel discussion on...

Pet food

Pet food sustainability trends:

insights from Osservatorio Immagino

The creation in 2013 of Immagino, the digital brand content management web service of GS1 Italy Servizi that captures and digitises all the information available on physical product labels as well as images, has enabled the creation of a database that today contains the digitised information of more than 133,000 FMCG products distributed throughout Italy, in hypermarkets and supermarkets.

The information captured on the label includes the nutritional table, description, certifications/logos, allergens, origin of the raw material, additives, preservation and packaging methods, marketing claims, and everything available on the label.

The reading and analysis of this information has given rise to the Osservatorio Immagino, the biannual study by GS1 Italy that monitors new and hitherto unexplored consumption phenomena. We therefore learn about the consumption of so-called ‘free-from’ products – i.e. those with claims on the label that communicate the absence of certain ingredients – and enriched products, how ‘gluten-free’ or ‘palm oil-free’ are evolving, how the veg and organic universe is growing, the consumption profile of those who are concerned about food intolerances or the Italian nature of products, and how important the sustainability of the product and packaging is.

This new approach to consumer phenomena has also made it possible to analyse the world of pet food through the same lenses: in the year 2022, more than 4,700 products were covered by this analysis amongst those handled by hypermarkets and supermarkets in Italy.

The analysis of pet food products through the phenomena detected for human food consumption revealed a first important piece of evidence: alongside greater attention to their own health and nutrition, pet owners show the same attention to food for their pets, and therefore the attention to issues impacting on the choice of human food products is reflected in the heightened awareness of pet owner consumers.

The increasing sales volumes (understood as the number of pieces/litres, etc. sold and thus the KPI that best expresses the consumption trend by neutralising the effect of price inflation) for almost all of the product clusters analysed, despite the substantial price increases, underline that this is an extremely dynamic market, destined to grow further and, at the moment, not very price-elastic.

Source: GS1 Italy Osservatorio Immagino, ed. 1, 2023.

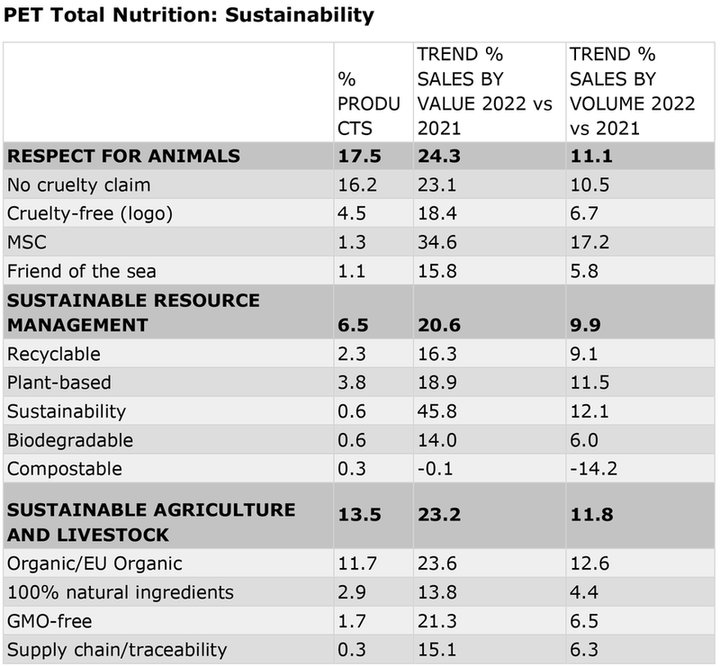

Sustainability in the analyses of the Osservatorio Immagino is addressed in different study areas: respect for animals, sustainable resource management and sustainable agriculture/farming. What emerges first and foremost is how the attention of animal feed companies towards the topic of sustainability continues to remain high and to grow year after year: the number of products on the shelves that display on the label and communicate to the consumer the topics of product sustainability, under the various aspects already outlined, both recyclability and packaging, is increasing.

All products included in this analysis, by sustainability claim, reveal a lively trend, with the exception of ‘compostable’ packaging.

One of the hottest topics concerns packaging recyclability: we are talking about a set of products that in 2022 would generate more than 89 million euros in the Italian market analysed. The interest in packaging sustainability is described both on the supply side, which offers almost 140 products with biodegradable or recyclable packaging, and on the demand side, which is expressed with positive results in terms of value and volume trends.

The focus on the content of the products is also high, confirming the findings of the other claims that reassure the consumer regarding the quality and wholesomeness of the product, guaranteed, in this case, also by the observance of sustainable agriculture and animal husbandry: ‘Organic/EU organic’ is the largest market in terms of the number of references, which are as many as 552 in the range, and in terms of turnover achieved, which exceeded 135 million euro in 2022. This product cluster is also one that receives a particularly dynamic response from the consumer: +12.6% in volume against price inflation that contributes to an increase in sales of +23.6%.

Pet owners also demonstrate especial concern for the respect of animals: products that mention this issue, through various logos and certifications, register high volume sales trends. The ‘Cruelty-free’ claim is particularly widespread (776 references) against a market turnover of over 181 million, with a volume sales trend of +10.2%. Less widespread and with a less significant turnover behind it is the ‘MSC’ logo, which, however, has a volume trend of +17.2%, the highest of all sustainability-related claims.

References and notes

Panelists