FROM ENVIRONMENTAL IMPACT

TO SOCIAL PURPOSE

IN BEAUTY AND PERSONAL CARE

SPECTRUM OF SUSTAINABILITY:

SUSTAINABILITY

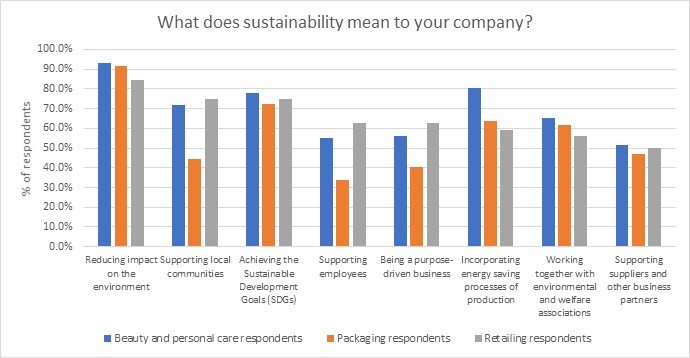

While sustainability is most closely associated with reducing environmental impact, Coronavirus (COVID-19) has brought on a new consciousness of “purpose over profit”, which is a more holistic approach that aims to encompass social, environmental and economic value with sustainability. The leading beauty and personal care markets have a responsibility to lead sustainability momentum. Large-scale cooperation and partnerships across the supply chain will be crucial to normalise sustainability behaviour in the beauty and personal care industry.

INTRODUCTION

Sustainability has three pillars—economic, environmental, and social. Beauty brands and retailers tap into these three pillars through a wide range of sustainable product features, such as being fair-trade certified (economic sustainability), using locally sourced ingredients (environmental sustainability), or supporting the global wellbeing of both customers and employees through the support of specific causes and initiatives (social sustainability). It comes as no surprise that overall, sustainability is viewed as reducing the impact on the environment. In fact, much of the beauty industry’s innovation has centred around this goal.

SUSTAINABILITY MOST CLOSELY ASSOCIATED WITH REDUCING ENVIRONMENTAL IMPACT

Source: Euromonitor International Voice of the Industry Sustainability Survey, 2020, conducted during June 2020.

Kayla Villena is a senior analyst at Euromonitor International based in Chicago. She analyses the beauty and personal care industry, looking at changing consumer preferences, megatrends influencing adjacent industries, and the ripple effects from industry disruptors and innovators. She is a regular contributor to Natural Products INSIDER and Beauty Packaging and has been featured in Bloomberg, The Wall Street Journal, CosmeticsDesign and Glossy, among other publications.

Gabriella Beckwith is a London-based Consultant at Euromonitor International specialising in the Health and Beauty sector. Gabriella’s expertise comes from working closely with a number of clients across the Beauty and Personal Care space in Europe, ranging from brands to manufacturers. Her comments have been featured in a variety of business and trade press online, including Vogue Business, Women’s Wear Daily and The Business of Fashion.

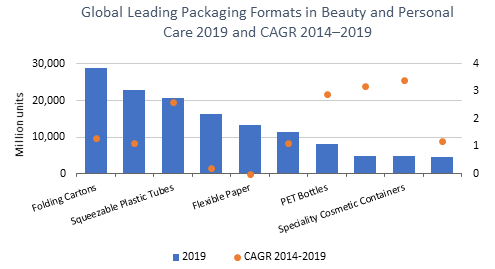

Refillable packaging is one of the most dynamic innovations of late, gaining traction among smaller independent players, mid-size players, and multinational CPG firms. Although refillable packaging is not new, it has evolved into an area of growth and opportunity across beauty categories, since it helps drastically reduce packaging waste. Notable innovations include Charlotte Tilbury’s lipstick refills for colour cosmetics and Victor & Rolf in fragrances.

INNOVATION IN REFILLABLE FORMATS EXTENDS ACROSS ALL BEAUTY CATEGORIES

Tapping into alternative packaging materials is another key area of growth in the beauty industry, due to the desire to seek alternatives to virgin plastic, the most widely used packaging types in beauty. While brands are increasingly using post-consumer recycled (PCR) content, in addition to the wider use of recyclable aluminium and glass, some brands are exploring alternative materials such as bio and plant-based formats, including sugarcane, cork, and bamboo. Plastic-free packaging, like Meiyume’s moulded pulp range that is typically used in dunnage or egg carton packaging, and L’Oréal’s Seed Phytonutrients’ cardboard packaging, are also gaining pace.

Alternatives beyond bio- or plant-based sources also involve tapping into manufacturing by-products. For example, L’Oréal partnered with LanzaTech and Total to develop a packaging format made from captured and recycled carbon emissions, furthering the possibilities of reusing industrial carbon emissions. Other innovations that reduce the impact on the environment include zero-waste packaging, upcycling food waste, reusing plastic found in oceans, and water-efficient and water-free formulas. Innovations in mono-materials, such as Aptar’s Inifinity mono-material pumps, have also contributed to the recyclability of beauty packaging’s life cycle.

BRANDS EXPLORE ALTERNATIVE PACKAGING MATERIALS FOR THE FUTURE

Source: Euromonitor International.

Despite various innovations that tackle multiple facets of sustainability, the beauty industry is pressed to adopt sustainable initiatives on a wider scale and within a shorter time frame. The leading beauty and personal care markets have a responsibility to lead this charge, given the fact that their environmental footprint is so much larger, relative to smaller markets.

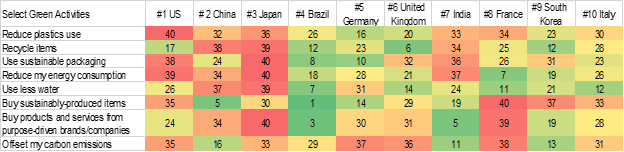

In 2020, Euromonitor asked respondents across 40 markets whether they engage in a range of sustainable or ethical behaviours as part of a Lifestyles survey. Euromonitor then ranked each of the 40 markets by the highest percentage of respondents that engaged in each behaviour, with markets denoted in green that rank the highest performers of ethical behaviours, yellow as mid-range, and red as poorer performers. Finally, the results from the top ten beauty and personal care markets were spotlighted to juxtapose consumer behaviour of green activities against the markets with the greatest beauty and personal care footprint.

THE LEADING BEAUTY MARKETS SHOULD LEAD THE CHARGE

Country Rank of Top Ten Beauty and Personal Care Markets by Green Activities 2020.

Source: Euromonitor International Lifestyles Survey, 2020. Note: Rankings organised by highest percentage of respondents out of 40 countries surveyed. Beauty and personal care markets ranked by 2019 market size in RSP USD current-fixed exchange rates in 2019 prices.

The top three beauty and personal care markets in 2019—US (USD91.2 billion), China (USD71.7 billion) and Japan (USD39.6 billion)—account for some 40% of the global beauty and personal care market, but rank among the lowest tiers of performing sustainable or ethical behaviours (as seen by the dominance of red and some yellow). Notably, the US ranks last out of Euromonitor’s 40 surveyed markets in reducing plastic use, while Japan ranks last in using sustainable packaging and purchasing from purpose-driven brands. In contrast, Brazil ranks higher in terms of consumers performing green activities, suggesting that Brazilian consumers may be very receptive to beauty companies’ sustainable initiatives since they already practice some behaviours in their daily lives.

Weighing the penetration of sustainable activities against the footprint of their respective beauty and personal care markets will help shed light on markets with the most “sustainable white space” that could benefit from innovation (such as the US, China, and Japan). Knowing where to look for best-in-class examples of beauty brands interacting with a sustainably-minded populace (such as Brazil and South Korea) can also aid in inspiring sustainability initiatives elsewhere.

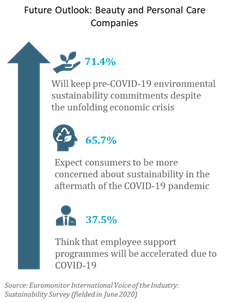

While the environmental focus has led sustainability initiatives so far, COVID-19 has bought a new consciousness that goes far beyond merely compensating for a company’s negative impact on people and the planet. A 2020 Euromonitor Voice of the Industry sustainability survey found that different players of the beauty supply chain define sustainability differently, with discrepancies notable among players in supporting local communities, supporting employees, and being a purpose-driven business. These three facets play into the purpose-driven components of sustainability, which are currently being re-envisioned in the beauty and personal care industry as a result of the humanitarian crisis caused by COVID-19.

Moving forward, consumer, brand, retailer, and supply chain partnerships will be crucial to addressing sustainability challenges in both developed and emerging markets. “We are in this environmental crisis in part because companies’ conversations and decisions happen in silos. For example, packaging designers aren’t talking to material recovery people,” stated Mia Davis, who leads sustainability initiatives for US beauty specialist retailer Credo. However, empowered and knowledgeable consumers demanding transparency will put the beauty supply chain under scrutiny to honour commitments for a more sustainable and ethical future.

Original article first appeared on Euromonitor’s blog.

DEFINITION OF SUSTAINABILITY EXPANDS TO ENCOMPASS SOCIAL PURPOSE

Source: Euromonitor International Voice of the Industry: Sustainability Survey (fielded in June 2020).